Renters Insurance in and around Georgetown

Your renters insurance search is over, Georgetown

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Georgetown Renters!

There's a lot to think about when it comes to renting a home - internet access, location, furnishings, townhome or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Your renters insurance search is over, Georgetown

Renting a home? Insure what you own.

Why Renters In Georgetown Choose State Farm

When the unpredicted theft happens to your rented townhome or home, usually it affects your personal belongings, such as a desk, a bicycle or a smartphone. That's where your renters insurance comes in. State Farm agent Mark Penuel has the knowledge needed to help you understand your coverage options so that you can protect yourself from the unexpected.

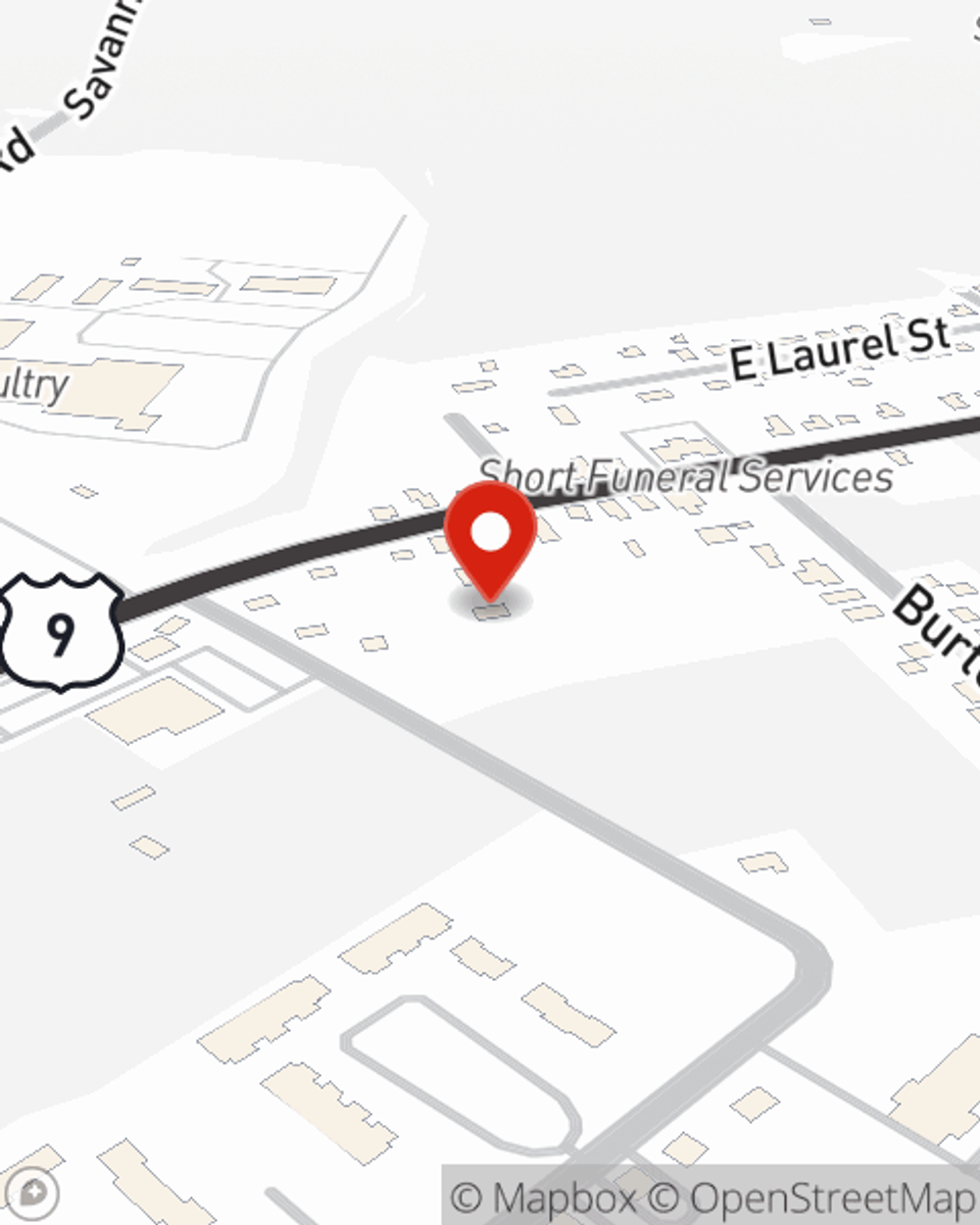

Renters of Georgetown, State Farm is here for all your insurance needs. Visit agent Mark Penuel's office to get started on choosing the right savings options for your rented apartment.

Have More Questions About Renters Insurance?

Call Mark at (302) 856-7724 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Mark Penuel

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.